Industries across the world are at the cusp of industrial revolution 4.0. Apart from transforming the means by which we communicate today, new-age technologies are digitizing almost every vertical across sectors. Although generally slow in getting attuned to digital innovations, the real estate industry is also reaping tremendous benefits from cutting-edge technologies. These include obtaining fractional ownership through Blockchain Technology, operating automated homes with the Internet of Things (IoT), and manufacturing modular components through 3D Printing.

While these advancements are speeding up the process throughout the project’s lifecycle; data storage, data crunching, and retaining information flow remains a critical issue. This becomes more important as there are currently 637 million Internet subscribers and 500 million smartphone users in India. In terms of data usage, close to 11 GB of data is consumed every month per smartphone by these subscribers (RICS-CBRE 2020 Report on Data Centres).

Data usage and storage is one aspect, however, the need to search for alternate investment classes that can offer long-term benefits is gaining traction. This synergy between the rising demand for data centres in India and the need for investing in real estate assets other than residential and industrial projects is giving rise to the development of “data centre real estate” in India.

What are Data Centres?

The new-age, globalization driven world, works cohesively through a widely-connected digital network. While generating an input from the front-end, say a website is easy. Collating, assessing, storing and managing massive amounts of data at the back-end is where the actual complexity arises. To handle this, data centres in India and across the world play a significant role.

Data centres, also known as ‘data/server farms,’ are specially designed buildings/properties/facilities where an array of computing and networking devices are placed in tandem. These systems then collect, store, analyze and distribute large amounts of data throughout the network. Since these facilities deal with sensitive information and are built for a specific purpose, they have stringent access restrictions.

What are the Components of an Efficient Data Centre?

Whether it is the data centres in India or the ones stationed across the world, they are critical for running the simplest of operations such as file sharing to handling complex functions related to predictive analytics and artificial intelligence. Hence, the infrastructure of these centres is an amalgamation of real estate facilities, network structure, computing resources, and storage units.

| Components | Description |

| Real Estate Facility | In companion to the conventional commercial real estate assets, data centres in India have to be custom-made i.e. it has to be designed and built in such a way that it can efficiently support the data centre’s hardware and software requirements. This includes- 1. Power Distribution2. Cooling Systems3. Backup Generators4. Uninterruptible Power Supplies |

| Network & Storage | With an array of hardware and software systems, a proper connection channel has to be provided. This includes connectivity to servers, data centre services, etc. |

Why is India Becoming a Preferred Market for Establishing Data Centres?

According to the statistics presented in Synergy Research Group’s report, the data center market in India is poised to grow at 12% compound annual growth rate (CAGR) between 2019-2024 period. There are multifarious reasons that are pushing the demand for the development of data centres in India. Some of which have been enumerated below:

- Increasing internet penetration and a large number of smartphone users

- Development of 100 cities identified under the Smart Cities Mission

- With the rising population, the data footprint in India will grow significantly

- Future use of 5G and real estate/IT/Retail/Commerce/Streaming services

- Personal Data Protection Bill (2019) lays emphasis on data localization

- Incorporation of new technologies like AI, BIM, Blockchain across sectors

In addition to the aforementioned factors, pandemic-induced lockdowns ushered a new wave of conducting economic activities. Many coveted companies such as TATA Steel, Infosys, and Maruti Suzuki are evaluating profiles that can perhaps work from home even after the pandemic subsides completely. Additionally, the advent of online education platforms, business conferences/webinars, video-based medical consultations, and significant increase in e-commerce transactions has fueled the demand for the establishment of data centres in India.

Did you Know?

Quite recently, the Greater Noida Industrial Development Authority allotted 6 acres of land to NTT India, to set up a data centre of 70 MW capacity. This comes after the authority allocated 20 acres of land to Hiranandani Group in Knowledge Park-V to set up a 200 MW data centre. These projects combined, offer 3-fold benefits.

First, it has the potential for generating employment for thousands of people. Second, as more jobs are created, the demand for residential real estate along with retail, healthcare, and education-related infrastructure will increase. Third, and most important, these centres will aid in capacity building for storing and managing the copious amounts of data that is being consumed today.

How do Data Centres in India Function?

The data centres in India, at present, operate on 2 models – Captive and Co-location/Third Party Model. In the captive model, organizations work on “Company Owned Company Operated” principle where the organization concerned purchases, operates and manages the data centre on its own.

In the Co-location/Third Party model, on the contrary, companies purchase data centres, lease them out, and allow external/third-party sources to host services. These services can range from providing power supply and security amenities to cooling needs for the data centre.

Although data centres deployed on the captive model enjoyed a significant market share initially, the demand is now tilting towards third-party models. This is because running individual centres, hiring staff, and maintaining infrastructure requires extensive financial backing. Which doesn’t sound monetarily feasible for new-age startups or MSMEs. This model, however, can bring long-term benefits for well-established organizations that have sufficient financial resources to manage extensive amounts of data.

Which are the Best Locations to Establish Data Centres in India?

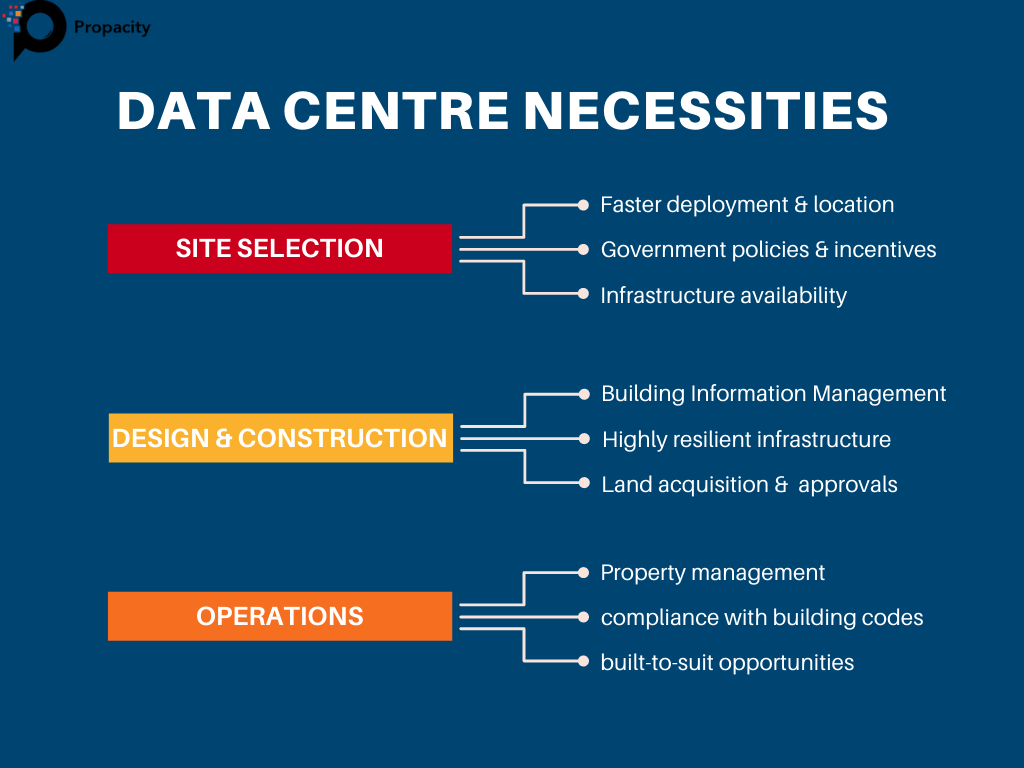

Earlier, the demand for data centres in India was not very high. However, regulatory and policy-based incentives coupled with the proposal of building economic zones specifically for data storage has fuelled the demand. As discussed earlier, these facilities cater to a specific cause and the infrastructure differs heavily from the traditional commercial projects.

Although important, location can not be considered as the only factor for choosing the site for data centre real estate projects. Every parcel of land comes with a set of safety or natural hazards. The site can either be in a disaster-prone area or it might be in close proximity to a large number of electrical towers that can interfere with the functioning of data centres. Hence, the emphasis has to be laid on the following factors:

- Infrastructure & Demand

Power supply and fiber availability are non-negotiable in choosing the ideal site location for establishing data centres in India. However, whether the site is actually in demand and does it offer convenience, in terms of location advantages, should also be considered.

- Under-sea Cable Landing Stations

Under-sea cables connect data centres in India to strategic cities in the Middle East, South Asia, Africa, SE-Asia, as well as Europe. However, as the distance from these locations increase, the cost of pulling the cable inland also increases. This is the reason why Mumbai and Chennai have emerged as the most popular cities for the development of data centres.

- Population and Economic Centres

Yes, availability of under-sea cables is an important factor. However, considering urban population and the proximity to large organizations also plays a significant role in selecting the site for a data centre. For instance, Delhi-NCR, Bangalore, Ahmedabad, etc are some of the most important economic and financial centres in the country that house India’s and world’s top companies.

- Government Policies and Incentives

States such as Maharashtra, Andhra Pradesh, Uttar Pradesh, and Telangana have announced multiple fiscal and non-fiscal incentives for the development of data centers. These include, but are not limited to offering land subsidies, tax or duty waivers, and classification as essential service, etc

Such policies have and will further increase the demand for establishment of hyper-scale data centres. As the demand will increase, it will boost the development of the commercial real estate sector.

What are the Major Challenges Obstructing the Growth of Data Centres in India?

The first and the foremost challenge associated in building data centres in India is the unavailability of cheaper land parcels near commercial areas. If the land costs are high, the operating and renting costs also increase. Plus, building data centres in popular localities of Mumbai or other cities that are saturated, in terms of land availability, makes the construction more expensive. While availability of land parcels is one aspect, delayed permit issuance, zone or use restrictions, and distance from cloud service providers is also a concern for developers.

Another issue pertaining to the data centres is with respect to the ever-evolving technologies. As the previously constructed data centres become outdated, selling them at profitable rates might be slightly difficult for investors. Providing uninterrupted and cost-effective electricity is one of the primary requisites of running data centres in India. However, DISCOMs across the country are already reeling under the financial crisis.

How MeitY’s Draft Data Centre Policy Can Benefit the Data Centre Real Estate?

Considering the importance that the Indian data centre market is gaining, the Ministry of Electronics and Information Technology (MeitY) released a draft policy in 2020. These provisions aim at creating a “congenial, competitive and sustainable” environment for the development of data centres in India in the following ways:

- The most important provision that the draft policy entails is regarding the government’s push towards granting “Infrastructure status” to the Indian data centre segment. If given, it will allow investors to avail long-term credits from domestic and international lenders. Along with this, it will also offer a single window clearance system that will fasten up and institutionalize the process.

- The policy also aims at promoting pre-provisioned Data Centre parks, to enable ‘plug and play’ models. “Pre-provisioned”, here, refers to the systems (primarily hardware) that are pre-tested and pre-installed in a manufacturing unit in order to reduce deployment time. Therefore, companies that need to build new facilities under tight deadlines, or who want to scale up at minimum expenses will benefit tremendously from this model.

This will, in turn, benefit real estate developers, who can simply build a suitable structure and without worrying about the additional necessities related to these components.

- Establishing at least 4 Data Centre Economic Zones (DCEZ) as a Central Sector Scheme is one of the most significant provisions stated in the draft policy. The idea is to create a healthy ecosystem that is an amalgamation of data centres, R&D units, IT and non-IT infrastructure, and cloud service providers. With so many facilities to be housed at one place, real estate builders and investors will get another asset class to invest in.

- The requirements for setting a data centre, in terms of infrastructure and construction techniques, are totally different from other emerging real estate assets. Therefore, the policy envisages creating a separate category code for Data Centres in the National Building Code, 2016. It will aid builders and developers to construct commercial assets with best-in-class specifications that suit the requirements of the companies.

- In order to reduce the overall import burden of the country, the draft policy also aims at encouraging the use and development of indigenous hardware and software systems. For this, many provisions have been added in the policy.

For example, equipment manufacturing companies from across the globe will be incentivized so that they can set up their IT/ Non-IT units in India. This will not only help in catering to local and well as global data demands but will also aid in the development of the Indian real estate sector

- In order to provide long term electricity at reasonable costs to data centres in India, the policy aims at collaborating with the Ministry of Power and other organizations to use solar- or wind-based energy services to power these centres.

Real Estate Asset Management: A Catalyst in India’s Thriving Data Center Industry

India’s data center market is experiencing remarkable growth, propelled by the nation’s digital transformation. This expansion presents a valuable opportunity for real estate asset managers who can leverage this flourishing asset class.

Why Data Centers are the New Real Estate Gold

Rising internet use in India fuels voracious data demands. Consequently, data centers proliferate swiftly to house the needed computing gear.

A Glimpse into the Future: Upcoming Data Center Projects

- Mumbai: A hub for finance and technology, Mumbai is an ideal location for data center development. Key players like Adani Group and Hiranandani Group are planning significant expansions.

- Chennai: This southern hub boasts a strong presence of IT companies and submarine cable landing stations, making it an attractive destination for data center investment. Leading companies like Yotta Data Services are expanding their footprint here.

- Delhi NCR: The National Capital Region offers a vast talent pool and robust

infrastructure, drawing data center operators like STT GDC India. - Pune: A major IT hub, Pune is witnessing a surge in data center projects. Established players like RMZ Corp, which recently announced plans to develop data centers in partnership with Brookfield Asset Management, are leading the charge.

Real Estate Asset Managers: The Driving Force

Major Asset Managers in India:

- Brookfield Asset Management: This Canadian powerhouse partnered with RMZ to invest in Indian data centers, recognizing the potential of this market.

- Digital Realty: An American data center REIT (real estate investment trust) joined forces with Reliance Industries to develop data centers in India, leveraging their combined expertise.

Emerging Data Center Projects and Asset Management Expertise

- Microsoft’s Pune Data Center: This first-of-its-kind facility will support Microsoft’s cloud services.

- AWS’s Distributed Data Centers: Amazon Web Services plans to create four data centers strategically located across key Indian cities.

- Equinix’s Mumbai Expansion: Equinix is investing heavily to construct a third data center in Mumbai, extending its reach across India.

Real estate asset managers play a pivotal role in managing these complex data center projects

Their expertise ensures:

- Strategic Planning: Developing long-term strategies to optimize data center performance and achieve business goals.

- Operational Efficiency: Implementing best practices for energy use, maintenance, and risk management to enhance efficiency.

- Financial Analysis: Conducting thorough financial analysis to identify cost-saving opportunities and maximize revenue generation.

Leading Asset Managers in the Indian Data Center Space

- CBRE: Engaged in developing data centers in key cities like Hyderabad and Mumbai.

- Jones Lang LaSalle (JLL): Invests in data centers, focusing on providing flexible, scalable, and secure data storage solutions.

- Cushman & Wakefield: Offers services related to data center development, management, and operations.

- Blackstone: Makes significant investments in the Indian data center market, including developments in Chennai and Mumbai.

Large-scale initiatives such as the smart cities mission and digital India will propel the development of real estate and digital infrastructure across the country. Although India is showing excellent post-pandemic recovery, the work from home model is still being followed by multiple organizations. This will also act as a catalyst in the establishment of data centres in India, which, in turn, will develop the commercial real estate sector significantly. Perhaps, it is likely that in the coming years, India will witness a surge in the inclusion of data centres in REIT portfolios. These centres, will, therefore, prove to be the silver lining for the development of the commercial real estate segment not only in the immediate period but also for the time to come.

![Well, #GrowWithPropacity is here to educate you all about all things Real Estate.

Follow to stay updated in Real Estate!

[Real Estate, Construction, Real Estate Tips, Real Estate Growth, Real Estate Industry, Carpet Area, Super Area, Built Up Area, Home Buying Tips, Home Buyers, Property]](https://propacity.com/blogs/wp-content/plugins/instagram-feed/img/placeholder.png)

Leave a Reply