Gst on Real estate is important to be understood by all real estate stakeholders, with change in tax structure brought by the new gst regime, it is crucial to understand how it affects real estate industry, here in this article we will discuss and explain this new taxation structure.

Benjamin Franklin had once quoted that everything in life is uncertain except paying taxes. However, when the tax regime is complex, especially for sectors like Real Estate, an unnecessary financial burden is added on the homebuyers and developers.

Until 2017, the builders had to pay Value Added Tax (VAT) along with numerous other taxes such as service tax, octroi, central excise, LBT, etc. This not only increased the overall project cost for developers, but the homebuyers also had to shed a lot of money to invest in real estate. The non-uniform tax rates across India and the tax-on-tax situation further added to the woes.

To bring to an end the complexities involved in every sector of the economy, including the real estate, government introduced the much-awaited Goods and Service Tax in 2017. In this blog, we will shed light on how GST on real estate has transformed the face of the sector, and at what percentage are different types of real estate investments taxed.

What is GST?

With the motto of “one nation, one tax,” the Goods and Services Act came into force in 2017. The commodities are now categorized into different slabs (zero tax, 5%, 12%, 28%) and are taxed accordingly.

The implementation of GST has changed the way goods and services were traditionally taxed. A plethora of taxes like VAT, octroi, LBT, etc have now been subsumed under one category.

What is interesting to note is that GST is a destination-based tax i.e. the goods and services are taxed where they are procured or consumed, and not where they originate. This allows the raw material procurers to harness the benefits of the Input Tax Credit (ITC).

With one tax per slab, GST has ushered a new wave of uniformity across sectors, including real estate. Hence, it is touted to be the biggest tax reforms in India.

What is ITC in the Real Estate Industry?

From architects and promoters to raw material providers and commissioning agents, there are multiple stakeholders in the real estate sector. The payments incurred by the promoters in the purchase of construction materials and services attract GST. To reduce the burden of goods and services providers, the GST offers tax credits on the inputs used for manufacturing or creating G&S. This is called Input Tax Credit or ITC.

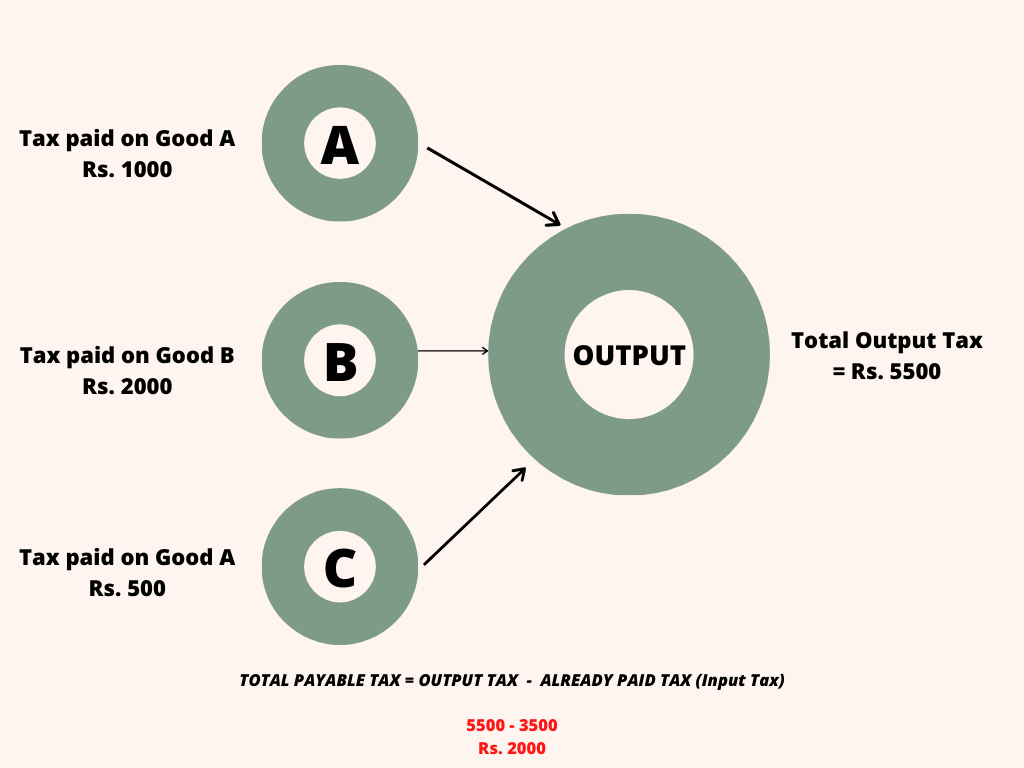

Let us understand the concept of ITC through the image given below.

You procured goods A, B, and C from different companies. These goods are the “inputs” that builders require for a project. So according to the ITC concept, the tax amount already paid will be deducted from the final output tax. Therefore, this reduces the cascading effects of taxation at different steps of project construction.

So when it comes to GST on real estate, only the part that adds value is taxed and the cascading tax effect is eliminated due to ITC.

GST on Real Estate: Important Terms

Before delving into the impact of GST on real estate, it is important to develop a thorough understanding of some commonly used terms.

1. Works Contract

Also referred to as a service of contract, a Work Contract is a mixture of goods and service where the latter plays a dominant role. Prior to the implementation of GST, a work contract covered both movable and immovable properties. However, post-GST, the work contract is restricted to the construction, fabrication, completion, erection, modification, etc. of an immovable property.

Hence, the act mandates treating works contract as a “supply of services.” As far as the ITC is concerned, it will not be provided when works contract services are offered for construction of an immovable property (except machinery and plant).

2. Affordable Real Estate Projects

Residential properties that have a carpet area of 60 square meters (metropolitan cities), 90 square meters (non-metropolitan cities), and are valued up to Rs 45 lakh (both metropolitan and non-metropolitan areas) are categorized as affordable properties.

Here, the metropolitan cities refer to Mumbai, Bengaluru, Chennai, Delhi-NCR, Hyderabad, and Kolkata.

The residential properties which were classified as affordable homes before the new tax regime came into force i.e. before 31st March 2019 also fall under the affordable housing category.

3. On-going Project

An ongoing or an under-construction project is categorized based on the commencement certificate, completion certificate or project bookings. Enlisted are some conditions that must be satisfied in order to classify a real estate space as an under-construction/on-going project:

- The project hasn’t received the completion certificate on or before 31st March 2019.

- Houses are not booked completely on or before 31st March 2019. However, this criterion does not apply to slum rehabilitation projects.

- Occupation certificate has been issued for only a part of a large real estate project.

- A commencement certificate has been issued for the identified projects by the competent authority and it has been certified by an architect, a licensed surveyor, or a chartered engineer on or before 31st March 2019.

- Commencement certificate issued by a registered surveyor, architect, or chartered engineer on or before 31st March 2019 for projects which are not required to be registered by the competent authorities.

Note: The projects whose construction commenced before 31st March 2019 but the booking hasn’t started DO NOT fall in the on-going projects category.

Current Tax Regime for Under-construction/On-going Projects

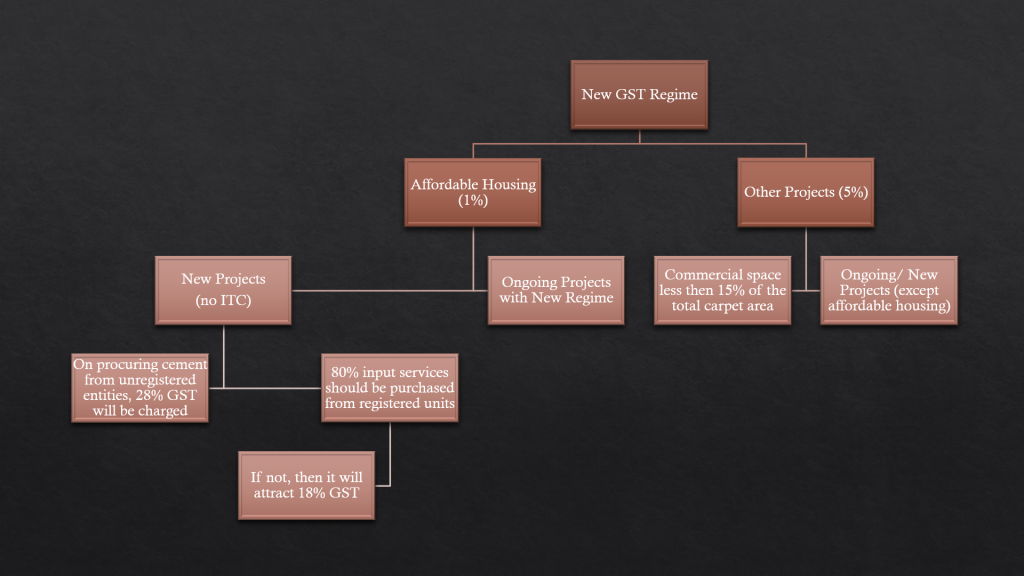

Builders of under-construction real estate projects [as of 31st March 2019] have the option of continuing with the old tax structure [12% / 8% for affordable houses] with Input Tax Credit or they can switch to the new tax regime [5% (other units) / 1% for affordable houses] without ITC. However, the new structure of GST on real estate is not applicable to homebuyers i.e. they cannot exercise the option of paying taxes as per the old or the revised rates.

| Type of Property | Affordable or General | GST Rates–Old Regime (with ITC) | GST Rates–New Regime (without ITC) |

| Residential Properties | On-going/under construction projects not under the purview of PMAY Credit-Linked Subsidy Scheme (CLSS)* On-going/under construction homes under the purview of PMAY Credit-Linked Subsidy Scheme (CLSS) | 12% 8% | 5% 1% |

| Commercial Projects | On-going/under construction not under the purview of PMAY Credit-Linked Subsidy Scheme (CLSS) On-going/under construction homes under the purview of PMAY Credit-Linked Subsidy Scheme (CLSS) | 12% 8% | 5% 1% |

*The Credit Linked Subsidy Scheme is a component of the Pradhan Mantri Awas Yojana (PMAY). CLSS allows people belonging to the economically weaker sections and middle-income groups to avail home loans at low EMIs.

GST on Real Estate: Ready-to-move-in Properties

As discussed in the important terms section, the works contract refers to those projects which are in the building or construction phase. The moment a property is completed and receives an occupation certificate, it no longer falls in the works contract category. So, when it comes to GST on real estate for ready-to-move-in properties, the developers cannot charge GST on completed projects.

GST on Real Estate: Construction Materials and Construction Services

Like other sectors, there are two aspects in the applicability of GST on real estate: Goods (construction material) and Services (construction service). What is important to note is that the GST rates not only varies from one construction material to the other but also differs between construction services and construction materials. Tabulated below are the GST rates in the current tax regime:

| Construction Materials | GST Rates |

| Fly ash, bricks, crude granite, roofing tiles, natural sand. | 5% |

| Glass, marble/granite (except blocks), prefabricated structural elements, refractory tiles, etc. | 18% |

| Cement | 28% |

Mixed Real Estate Projects

Those projects which have residential as well as commercial establishments, such as office complexes, shopping units, and party halls are called mixed real estate projects. These projects are bifurcated into 2 categories:

- Real Estate Project (REP)

- Residential Real Estate Project (RREP)

When it comes to the GST on real estate for mixed-projects category, the taxation scheme depends on the carpet area. For commercial spaces or REP, where the carpet area exceeds 15% of the total carpet area, the builder pays 12% GST with ITC. On the contrary, if the carpet area of the property is less than 15% of total carpet area, 5% of GST (without ITC) can be discharged by the developer.

GST on Real Estate Rent

When it comes to paying or generating income from rents, the GST rate varies based on residential or commercial spaces. If an immovable property is leased out for residential purposes, then no GST will be charged. However, if any commercial, residential, or industrial property is leased out for commercial purposes, then it will attract 18% GST charges. Here are some other provisions pertaining to the GST on real estate rents which you should know about:

- If you earn more than Rs 20 Lakh from properties rented out for commercial purposes, then you have to register yourself under GST and pay tax on the rents generated.

- A registered religious trust, which provides facilities for public, is exempted from paying GST if the rent of rooms, shops and community halls are less than Rs 1000/day, Rs 10,000/month, and Rs 10,000/day, respectively.

- As far as landlords are concerned, they are exempted from paying GST charges, unless the tenant uses the property for commercial purposes.

Real Estate Agents and GST

The enactment of Real Estate Regulation and Development or the RERA act has transformed the sector to a large extent. It was introduced with an aim to boost investments in the real estate sector and to bring relief to homebuyers by standardizing property development, selling, and buying practices. It also made mandatory for real estate agents to register themselves with the concerned states’ regulatory authority. Along with this, the commissioning agents (individuals who sell/purchase properties on behalf of other persons) have to compulsorily get registered under the CGST act since they are “offering services” to others. Hence, when it comes to GST on real estate, a GST rate of 18% is applicable on the taxable services provided by the agents.

The Goods and Services Tax (GST) has brought extra compliance responsibilities for real estate agents. They now have to learn all the new tax rules and make sure their services follow these regulations. This includes understanding what GST rates apply to their services and ensuring they properly report and pay those taxes.

Real estate agents also have to be careful about anti-profiteering issues under GST. They cannot manipulate or misuse the GST rates to overcharge customers unfairly. Agents have to strike a careful balance with their pricing and services to avoid penalties. Getting this balance wrong by trying to profit extra from GST could result in significant penalties against the agent.

Complying with GST takes effort, but it is necessary for real estate agents to operate properly under the new tax system. Mastering GST rates and rules while avoiding profit-seeking traps is crucial.

Registration and Stamp Duty

From on-going and completed projects to sale or resale of properties, stamp duties and registration charges form essential components to elucidate the impact of GST on real estate. Since the collection of stamp duties and the registration fee is the responsibility of states, the charges levied on these documents also varies from one state to another. While the stamp duty varies anywhere between 5%-10%, the registration fee is usually 1% of the total property value.

Impact of GST on Real Estate

Apart from the registration fee and stamp duties, the home buyers had to pay service tax and VAT for properties under construction. The problem was aggravated by the difference in the stamp duty and registration fee across states. However, with the implementation of GST, homebuyers have to pay a uniform rate of 12% for the on-going projects. This has made the home buying process more affordable and convenient.

The impact of GST on real estate is also visible on the residential or commercial project developers. Just like homebuyers, the builders also faced the brunt of multiple taxes on various input services. With the enactment of GST, multiple taxes are now subsumed under one group and the developers can gain benefits from the Input Tax Credit scheme.

GST on real estate and the enactment of the RERA act has thus ushered a new wave of accountability and transparency in the earlier unregulated sector. While homebuyers benefit from the reduced GST rates on affordable housing, the rental market gained considerable popularity.

The tax aspects of buying a home used to be complex because of the various different taxes that were involved in the business. However, with the implementation of the Goods and Services Tax (GST), this issue is not as complicated anymore. There’s only a single tax rate, which makes it simpler for people to make an estimate and purchase the home.

If you are buying a house that has not been completed yet, the rate is only going to be 12%. This way, it is more manageable for homebuyers to anticipate and plan their budget. First, houses have become less expensive, so more people have the opportunity to reach their goal of owning a house.

Helping builders and developers

For the construction industry, GST is very helpful. They can recover some of the taxes spent on building materials such as timber. It gives an opportunity to build houses in a cheaper way to lower the price for future buyers. With this new tax system now in place, developers and builders can work more effectively and build houses more quickly. Moreover, they can take advantage of this tax discount to invest in inexpensive housing programs. This, in turn, means more families can buy homes, strengthening the housing market.

![Well, #GrowWithPropacity is here to educate you all about all things Real Estate.

Follow to stay updated in Real Estate!

[Real Estate, Construction, Real Estate Tips, Real Estate Growth, Real Estate Industry, Carpet Area, Super Area, Built Up Area, Home Buying Tips, Home Buyers, Property]](https://propacity.com/blogs/wp-content/plugins/instagram-feed/img/placeholder.png)

Leave a Reply