Albeit at a slow pace in comparison to other sectors, technology has permeated almost every domain of the Indian real estate industry. While automated homes and artificial intelligence were already popular, various stakeholders are now incorporating predictive analytics in real estate in order to make transactions convenient and to develop future-ready buildings.

Real estate is one of those very few sectors which generally gets enormous amounts of consumer data through forms and brochures. With internet penetration reaching remote areas and real estate investors and home sellers searching for properties over the internet, stakeholders can identify prospective investors’ next moves in terms of buying or selling a property. The stakeholders can then use these data points to make better and forward-looking decisions.

But how exactly is that possible? The answer lies in the statistical technique called Predictive Analytics.

What is Predictive Analytics?

In scientific terms, predictive analytics refers to a multidisciplinary field where sourced data, statistical algorithms, and machine learning techniques work in tandem in order to recognize the likelihood of a particular event. However, to put it simply, “predictive analytics” helps systems and devices determine what’s likely to happen in the future based on the data of what has already happened in the past. The predictions are made by using the following:

| Statistics (analytical ability) | Data Mining (software tools & coding) |

| Machine Learning (techniques that teaches computer to model based on mathematical methods) | Predictive Modeling Techniques |

Past & Current Data + Analytics = Future Insights

Now to understand how predictive analytics in real estate works, let’s take an example.

Let’s say there are 1000 homes in a particular geographical area (XYZ). The statistical models of predictive analytics-backed systems will look at the previous buying-selling data related to that area. For instance, what were the common reasons for homeowners to sell their homes in the locality XYZ? Or, how many upcoming infrastructure projects are in line, in and around the region. Multiple statistical attributes will then be applied to this sourced data, which will help you generate future valuations.

Residential Sector Reaping the Benefits of Predictive Analytics in Real Estate

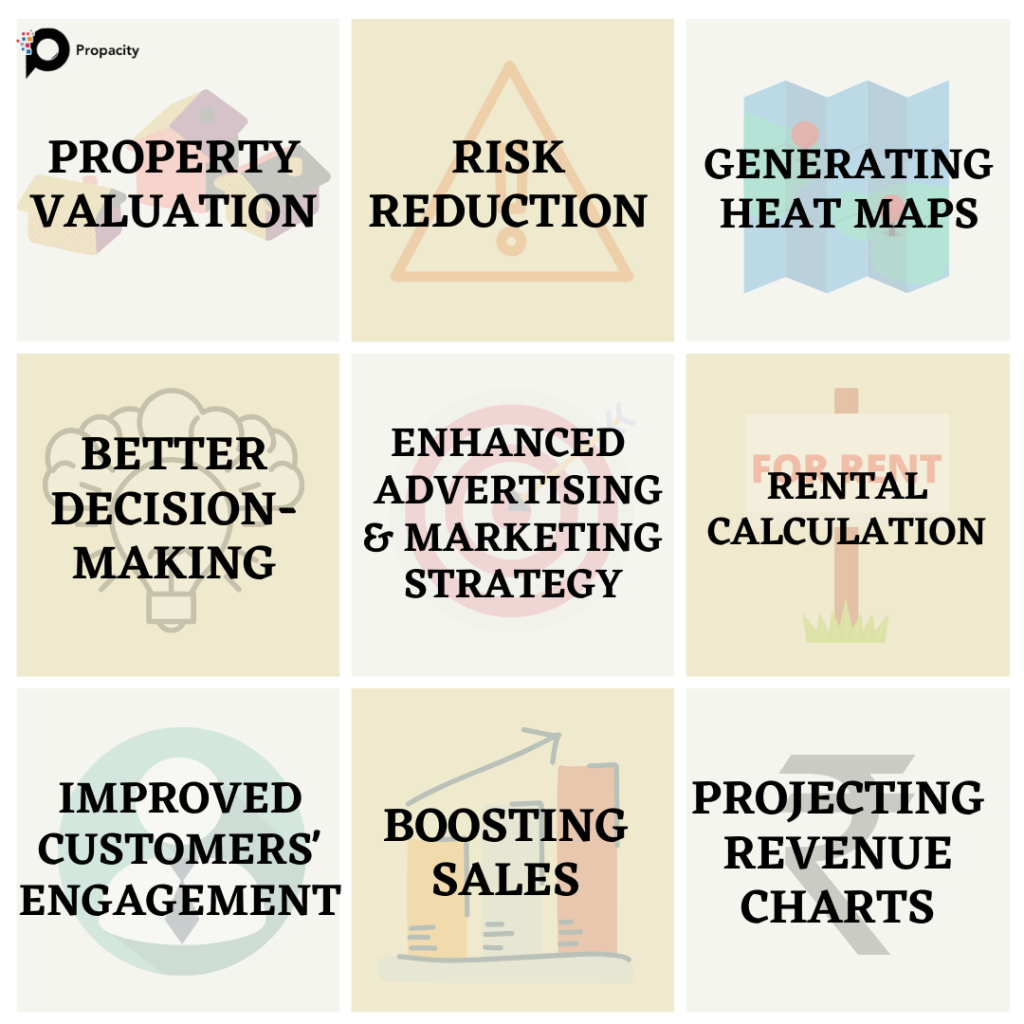

Rome wasn’t built in a day, neither did advanced technologies. However, the use of technologies such as virtual reality, the internet of things, and AI in real estate, particularly in the residential sector, has changed the landscape of the Indian real estate industry. Enlisted are the ways in which agents, brokers, builders, consultants, and other stakeholders are driving revenues by utilizing predictive analytics in real estate dealings.

1. Estimating Property Value

Agents and brokers take numerous factors like target audience, location and type of neighbourhood into consideration when defining the selling price of an asset. By using predictive analytics in property value estimation, agents can easily identify the spending patterns of investors, their commuting habits, and the areas where affluent or middle-income groups live or work. This helps in estimating a property value that aligns with the market rates.

Moreover, predictive models can analyze a wealth of hyperlocal data points beyond just neighborhood profiles. These include things like school district ratings, crime statistics, noise levels, future development plans, and even foot traffic patterns. By crunching all these granular factors, analysts can pinpoint pricing sweet spots and develop highly accurate automated valuation models. This provides a competitive advantage over traditional comparable-based appraisals.

Importantly, the predictive algorithms can be continually refined as new data is fed in, allowing property valuations to dynamically adjust to changing market conditions in real-time. This enables agents to optimize listing prices and negotiate from an informed, data-driven position.

2. Calculating Property Rentals

Tenants need a well-assessed estimate of the rentals that they’ll have to pay for a particular property. On the contrary, investors would want to understand the profitability of investing in an income-generating asset in a particular demographic location. Using predictive analytics in real estate, both issues can be tackled.

Infact, alongside finding a property with the highest ROIs, predictive analysis models also assist in finding assets based on your financial capabilities.

In fact, alongside finding a property with the highest ROIs, predictive analysis models also assist in finding assets based on your financial capabilities. By ingesting data on rental prices, occupancy rates, maintenance costs, and other variables across a city or region, these models can accurately forecast rental yields for specific properties.

This allows investors to evaluate the income potential and cash flows of an asset before committing capital. Landlords can also utilize predictive rental estimates to set competitive, market-appropriate prices that optimize long-term profitability while minimizing vacancies. On the tenant side, individuals can leverage these data-driven projections to budget accordingly and avoid overpaying.

The models can even account for seasonality trends, neighborhood nuances, and other micro-factors impacting rents. This level of granularity provides a significant edge over traditional market research and “gut feel” pricing approaches.

3. Predicting Price Appreciation

Whether it is for a client who intends to purchase a property or for a future investor, offering real-time insights on asset performance is essential for every real estate transaction. Predictive analytics in real estate not only enables agents and consultants to gauge through hundreds of properties simultaneously, but also provides a thorough understanding of pricing trends and market dynamics. This provides assistance in making informed decisions when looking at acquiring or selling off a property.

By analyzing historical sales data along with economic indicators, demographic shifts, planned developments and other factors, predictive models can forecast potential property price appreciation over different time horizons. This allows investors to identify areas positioned for significant value increases and time their purchases/sales accordingly to maximize returns.

The models can even quantify the appreciation impact of specific variables like a new transit line, retail hub or school opening nearby. Agents can leverage such granular insights to advise clients on high-upside investment opportunities. Prospective homebuyers can also utilize these projections to gauge if buying makes more long-term financial sense versus renting in a particular area.

4. Improving Home Search Experience

With internet penetration reaching Tier-2 and Tier-3 cities, home buyers now search for properties online before reaching out to the real estate agents. Now what if we tell you that you can understand a prospective client’s requirements before they reach out to you? Predictive analytics in real estate has made this possible.

Since predictive analysis involves data collection and evaluation, incorporating this technology on real estate portals will help you understand the user behaviour, their lifestyle preference, budget range and other key details. While with this data, you can offer a carousel with property suggestions and introduce consumers to new projects that match their requirements. The consumers, on the other hand, will save time in sorting through hundreds of property listings.

5. Targeted Advertising & Marketing

Although customers visit your website by clicking on say Google or Facebook Ads, there is no guarantee of converting each visit into a sale. Hence, the primary objective of any real estate advertising and marketing campaign is to target a particular segment of the total customer base. These campaigns are set in accordance with what the customer, with the highest chances of conversion, needs to know.

To do this effectively, predictive analytics in real estate marketing can be incorporated. This technology can identify, qualify and rank the leads with the highest probability of buying a property. Utilizing this technology will not only increase profitability but will also improve customer satisfaction by removing contact with low-quality leads.

Applications of Predictive Analytics in Commercial Real Estate

Commercial investments are capital intensive. Hence, an in-depth market research and financial valuation has to be conducted. The highly-advanced algorithms of predictive analytics tools takes into consideration a plethora of factors, identifies the loopholes and generates valuable insights. Here’s how predictive analytics in real estate is aiding in the development of the commercial sector.

1. Generates Heat Maps

Those who are familiar with the intricacies of the real estate sector know that location plays an extremely important role in finding the right investment. By incorporating predictive analytics in real estate, you can offer a “heat map” (which is nothing but sorting neighborhoods based on the input) to investors.

For example, if a client is looking for localities in Mumbai that can generate a good rental income, the heatmap would display such areas and neighbourhoods. This data is generated by assessing multiple conventional as well as unconventional metrics like:

- Occupancy rates,

- Number of educational institutes in vicinity,

- Proximity to commercial and business hubs,

- Food stores, retail outlets and shopping complexes,

- Infrastructural development and crime statistics, etc.

2. Provides Assistance in Investment-Specific Analysis

Whether it is short-term investments or long-term decisions, predictive analytics in real estate helps in identifying the type of investment that can generate excellent returns. For example, real estate investment trusts (REITs) can leverage the macro- (e.g: Funds from Operations) and micro-business factors (e.g: parking, social hubs in the vicinity, building space, etc.) to identify the most profitable income-generating asset.

As for builders, predictive analytics systems can be used to analyze and develop amenities or in-house specifications that homebuyers are looking most often for.

3. Improves Property Management Efficiency

Churn Modelling is a classical application of predictive analytics in real estate that helps in predicting customer behavior. For example, if a tenant wants to rent a unit, a churn model will predict the probability of the tenant vacating the unit within a given time frame.

In addition to this, predictive analytics examines data from various electronic equipment; detects anomalies in variables such as temperature, pressure and humidity; and identifies maintenance issues within the buildings. This prevents any power or other failures and helps in cutting down on unnecessary expenses.

4. Aids in Portfolio Management

Not restricted to only property management and future valuations, predictive analytics in real estate also helps portfolio managers in diverse ways. By combining data from conventional and non-conventional sources, portfolio managers can forecast the performance of an asset. For example, performance data sets of shopping malls can be clubbed with information obtained from sources such as, social media and physical store sales to analyze consumer behaviour.

Predictive analytics also helps portfolio managers to identify the sources of risk, say from macroeconomic conditions or regulatory changes, thereby aiding in smart decision making.

5. Projects Revenue Charts

By sourcing and evaluating datasets, offering a clear insight on pricing trends and market dynamics, and identifying various risks, predictive analytics in real estate can easily project a revenue chart for any commercial or residential project.

These revenue projections account for a multitude of factors like expected occupancy rates, rent escalations, operating expenses, cap rates, and risk-adjusted returns over the investment horizon. Developers and investors can leverage such data-driven forecasts to model various scenarios, stress test assumptions, and strategize project finances optimally from the start.

Key Challenges in Using Predictive Analytics in Real Estate

Although new technologies like real estate tokenization have a myriad of advantages, they also come with their own set of risks and privacy concerns. If we specifically talk about using predictive analytics in real estate, then some of the issues associated with the technology have been given a rundown below.

Lack of Awareness

As much as technology in real estate is revolutionizing the sector, many agents and companies are reluctant to adopt these systems. Either because they are unaware of the wide variety of datasets available or they have limited analytical ability and time to generate and assess insights.

Complex Models

Real estate is a very vast domain. In order to cover a wide region and to generate accurate and valuable insights, a number of input variables are added in predictive analysis models. This creates a highly complex and expensive model, making monitoring slightly difficult.

Data Risks

When it comes to the risks associated with predictive analytics in real estate, it can be segregated into authenticity and privacy. Huge datasets will be sourced and evaluated from multiple sources. So there can be privacy risks if the collected data includes non-public or personal information. Additionally, the authenticity and validity of datasets can be put into question if there is no transparency or set procedure to collect data.

Way Forward

Although business intelligence and predictive analytics have barely scratched the surface, it has already amped-up the game for various stakeholders in the real estate value chain. Whether it is investing in residential and commercial properties, selling assets, or managing portfolios, predictive analytics in real estate analyses key problems, identifies the root causes that need to be addressed, and powers smart decision-making.

Certainly, there are various challenges associated with the technology. Hence, instead of ad hoc adoption, predictive analytics-based tools should be deployed in a phased manner. Additionally, whether it’s a property management company or a commercial investor, the focus should be laid on improving data gathering, storing, and analyzing ability.

Just like other emerging technologies, predictive analytics in real estate is here to stay. The tools will generate relevant predictions based on customer priorities. However, how you can better the process of driving profits by levering the predictive analytics models depends on your digital strategy and the sources from where you intend to club the data from.

![Well, #GrowWithPropacity is here to educate you all about all things Real Estate.

Follow to stay updated in Real Estate!

[Real Estate, Construction, Real Estate Tips, Real Estate Growth, Real Estate Industry, Carpet Area, Super Area, Built Up Area, Home Buying Tips, Home Buyers, Property]](https://propacity.com/blogs/wp-content/plugins/instagram-feed/img/placeholder.png)

Leave a Reply