Real Estate Crowdfunding, what it is and why do we need it, let’s began understanding this by first looking at this example.

Remember how in our childhood days, we would save our pocket money to buy a packet of chocolates? Or how we would spend days on finding a birthday gift, when there was a dearth of discount offering e-commerce websites in India, for our close friend that was affordable yet memorable? However, our individual savings, often, couldn’t equate to the cost of a big bag of sweets or an expensive T-shirt.

In such scenarios, what was the best probable solution? Well, we would pool our money, buy a bag of chocolates, save a lot of money, and savoured the sweets-together! Basically, we started applying the concept of ‘crowdfunding’ from an early age, and quite efficiently.

Fast forwarding to the present age. Now we, as adults, mainly use crowdfunding for a social cause, individual purposes, or even for startups. While these applications are common, real estate crowdfunding is another arena which not only helps in diversifying portfolio, but assures a passive income from other sources.

Although crowdfunding is a simple but powerful idea, there are a few aspects that need to be understood, especially being a first time investor. So let’s understand what real estate crowdfunding entails and how to go about it.

What is Real Estate Crowdfunding?

Real Estate crowdfunding is one of popular way to raise money for project or investment, a alternative to loan or traditional investment, it has been quite popular lately, and offers great opportunity for read estate developers to go on in there business venture.

Instead of going through a bookish language, let’s understand the concept of real estate crowdfunding through an example.

Say that a real estate developer or an experienced investor identifies a commercial building in one of the premium localities of Bangalore, Karnataka. Now, this asset has a selling price of say, Rs. 4 crores but lacks modern facilities. Based on the market research and other necessities, the developer/investor realizes that if the building is renovated at an overall expense of Rs. 3 crores and is then leased out, the asset could probably reach a market value of Rs. 10 crores in the next 5-6 years.

Now the issue is, the developer/investor doesn’t have the necessary capital to modify the building. So instead of applying for a loan, the investor can turn this into a real estate crowdfunding opportunity where a group of investors or individuals will contribute individually towards the project.

This offers dual advantage. While builders can use the capital pooled for developing or refurbishing an entire real estate project. Investors can become shareholders in assets they earlier found difficult to acquire as individuals and can now diversify their portfolio.

What is the Process Involved in Real Estate Crowdfunding?

In every real estate crowdfunding project, apart from the crowdfunding platform, there are 3 important entities that play a significant role. These are-

- Sponsor

- Trustee

- Manager

The sponsor is an entity that identifies a lucrative opportunity, plans acquisition, finds the investors through crowdfunding platforms, and oversees the management and sale of a real estate asset. Once the investors are on board, a Special Purpose Vehicle (SPV) is created through which the asset, in which investors are the shareholders, is purchased.

Then comes a trustee, who is responsible for ensuring that the project complies with statutory requirements. Additionally, it also renders services with respect to corporate governance, holding security on behalf of lenders, advisory and management functions.

The Manager is responsible for handling the asset and the investments made in the respective property. Undertaking operational activities of the concerned real estate asset in accordance with guidelines of a statuatory body is also one of the primary duties of a manager.

How Are the Profits Divided?

The capital required for a particular project is contributed by the investors in exchange for a share of any profits the transaction produces. The profits that are generated from real estate crowdfunding will depend on the investment model chosen.

Equity-Based – In this, the investors either receive returns based on the rental income generated from the property or they earn profits based on their ownership percentage (in case the asset is sold).

Debt/Lending-Based – As the name suggests, the investors will “lend” money to the concerned entity. Although investors will not receive shares in the property, they will earn a fixed return based on the amount invested and the interest rate charged.

Differences Between Equity and Debt/Lending-Based Models

| Metrics | Lending-Based | Equity-Based |

| Risks | Although the risks majorly depend on the types of investment made, lending-based crowdfunding is generally safer to invest in. Even if the property is foreclosed, you will be paid first. | If the property does not generate much income or is foreclosed and sold, you will not receive returns. You may even lose some or all of your investments. |

| Returns | Although it is less risky, you will not earn profits if the project produces high rental income or the value appreciates over time. This is because you don’t have any ownership and the returns are fixed based on the amount invested. | Whether it is from selling the property after price appreciation or through higher rental incomes, the Equity-based real estate crowdfunding model offers better profits. |

| Holding Period | Whether it is a short-term or a long-term investment, the debt duration is always known and is usually shorter. | Holding period is long and can range from 5-10 years. |

So is Real Estate Crowdfunding Similar to REITs?

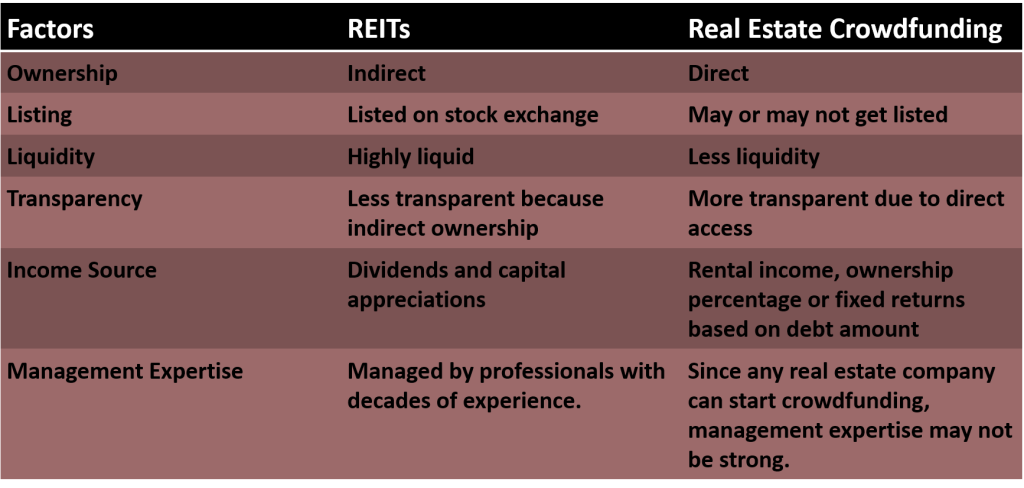

Operating like Mutual Funds, real estate investment trusts, or REITs are companies that own, manage or operate an income-generating property. So when you buy a share in a REIT, you are purchasing a share of the company that owns and manages the rental property i.e you are not directly investing in a real estate asset. The primary objective of creating REIT is therefore to allow small investors to foray into the real estate industry so that they can also earn passive income from these assets.

Real estate crowdfunding, on the contrary, works like investing in direct equities or stocks. You hold an ownership stake in an asset that you would be otherwise not able to purchase on your own. Let’s take a deeper look at these two investment models.

Crowdfunding vs Traditional Fundraising

Crowdfunding

In the lively real estate market of India, there are two different methods to get capital for property investments and developments: crowdfunding and traditional fundraising. Crowdfunding is a relatively recent idea that includes gathering small sums of money from many people, usually via online platforms.

This method has some benefits like lower entry barriers for investors, chances for diversification, and possibly higher returns compared with traditional investment ways. Crowdfunding platforms for real estate allow investors to look through different projects and decide on supporting them.

They usually provide detailed data and regular updates about the progress of the project. However, this area is dealing with problems linked to regulatory ambiguity because crowdfunding based on equity is mainly not regulated in India. Moreover, there are a lot of potential supporters who express doubt due to worries regarding scams and fraud.

Fundraising

Alternatively, the conventional method of raising funds in real estate usually involves collecting larger amounts from fewer investors. This could be through private equity investments or partnerships. Although it has become less common recently, this approach continues to have significance, especially for institutional investors or individuals with high net worth who are after substantial shares in properties or developments.

Conventional fundraising might include well-established networks and relationships within the industry which can provide more stability but may also limit opportunities for smaller scale investors. In India’s property market, crowdfunding and fundraising have similar problems.

These include a requirement for deep risk analysis and a close study of factors specific to the project like delays or failed projects. As the property market in India keeps changing, these different methods of getting funds might become more important. Crowdfunding has special benefits because it is easy to access and provides variety, while traditional fundraising continues to be attractive for investments on a bigger scale.

How to Assess the Risks Before Investing?

Although real estate is considered as one of the best asset classes to invest in, it’s rare to find an opportunity that could be declared as an absolute “low-risk” investment. So if you are planning to own stakes in a property through real estate crowdfunding, here are some of the factors that you must evaluate before investing:

- Property Type – While some types of commercial investments are recession-proof, the growth of others depend on the economic cycle. For example, during the pandemic, the occupancy in hotels across the country took a hard hit. On the contrary, an office building may not face such challenges as the leases are for long-terms.

- Execution Risks – An asset that needs funds for refurbishing may involve less risks. However, investing in real estate projects that involve ground-up development may turn out to be risky.

- Occupancy Status – If you are using real estate crowdfunding platforms to invest in a fully occupied Class A office, there are less risks associated with receiving returns. Now say there’s a project in which the existing property will be teared down and a new one will be built. In such cases, you need to evaluate whether the project’s target return assumes once it will be put out on lease.

Is Real Estate Crowdfunding Allowed in India?

At present, there are three types of crowdfunding methodologies that are allowed in India, namely, Donation Crowdfunding, Peer-to-Peer Lending and Reward Crowdfunding. So, a company that wants to raise funds collectively has to follow the provisions enumerated in the –

- Companies Act, 2013

- Securities Exchange Board of India Act, 1992

- Securities Contracts (Regulation) Act, 1956

- Depositories Act, 1996.

The Securities and Exchange Board of India (SEBI), which is the security market watchdog, has classified Equity crowdfunding as an unauthorised, unregulated and illegal process. Primarily because the investor may lack skills and/or experience required to examine the risks associated with the asset. In the expectations of receiving higher returns, small investors may get attracted to such investments, which can be risky.

Plus, since there are no well-framed guidelines related to real estate crowdfunding in India at present, such investments could affect the liquidity of a low risk appetite investor. So although experts are of the opinion that crowdfunding would transform the process of exchanging money, the concept, particularly in real estate, hasn’t taken off as of now.

Note: If a company wants to issue equity shares in India, they need to comply with the provisions enshrined in the Companies Act of 2013.

Regulatory Challenges and Opportunities

Crowdfunding for real estate in India has both challenges and chances that are shaping how it grows in the future. The rules and laws around it are different in different places, which can be a big problem for investors.

Investors need to understand the tricky set of rules that control crowdfunding websites, as well as the risks involved. This means they have to do a lot of research—things like checking financial reports, visiting the properties, and studying the market. They need to do all this to make sure their investments are safe and will make them money.

Despite these challenges, real estate crowdfunding also has great opportunities. It makes real estate investing possible for people with smaller budgets, empowering new investors. It also allows for more variety and flexibility in investment options to suit different risk levels and goals.

The Indian real estate market is complex, with its own rules and market changes. However, the government may enact new rules and policies to facilitate real estate crowdfunding. To maximize earnings, investors must keep up with new property markets and select the finest locations.

The Future of Real Estate Crowdfunding in India

With the government’s help for affordable housing and the digital economy, crowdfunding for real estate in India will become more popular. The new way to invest makes it easier for people with less money to invest in real estate. The degree of openness about crowdfunding that lets individual investors keep track of the projects’ performance and get updates makes people feel more confident and accountable.

As India moves to a digital economy, using technology in real estate crowdfunding could make things faster, cheaper, and with less paperwork. Platforms like Propertyshark and RealX are becoming more familiar with the public, which shows that real estate crowdfunding may have a bright future in India.

However, the main problems are related to rules and safety. More strict rules should be put in place to protect investors and stop illegal activities. The neighborhood of investments that are being digitized is the main concern. The real estate crowdfunding industry in India is expected to grow as long as regulations and security measures take it into account. This model suggests an alternative investment option for both small and large investors. Developers may also find it useful for diversifying their investment portfolios, which could attract more investors.

High liquidity, long and short-term holding period, and lack of management expertise are a few challenges. However, real estate crowdfunding can open the doors for investors who want to diversify their portfolios by investing in grade-A projects with low amounts. Also, with the Indian real estate market value poised to reach US$ 1 trillion by 2030, crowdfunding can become one of the biggest financial revolutions in the history of India, and work as an excellent funding alternative for real estate startups and developers.

![Well, #GrowWithPropacity is here to educate you all about all things Real Estate.

Follow to stay updated in Real Estate!

[Real Estate, Construction, Real Estate Tips, Real Estate Growth, Real Estate Industry, Carpet Area, Super Area, Built Up Area, Home Buying Tips, Home Buyers, Property]](https://propacity.com/blogs/wp-content/plugins/instagram-feed/img/placeholder.png)

Leave a Reply