Transfer of property act 1882 is one of the most important real estate laws in India, being aware of it is important, considering the importance of real estate as one of the popular investment options, ranging from residential apartments to real estate investment trusts. So after one makes a real estate investment property of transfer of act comes into play in the instance of transferring the properties to close and dear ones. provisions of this act may seem intimidating and complex, so to help investors understand the law, the blog will discuss each aspect of the act thoroughly.

If you are planning to hand over the rights of your property to someone else, then here is a blog that will explain the important provisions of the act and how you can transfer your property through different routes.

Historically before the Transfer of Property Act was established, property were transferred in India with regard to English laws. So resolve fragmented land laws in India, Transfer of Property act got enacted in February 17, 1882, and came into effect on July 1, 1882, marking a significant shift towards Indian law governing property transfers.

What is the Transfer of Property Act, 1882?

Transfer of property act or TPA is one of the most important real estate laws in India. It was enacted in 1882 to regulate the practice of handing over the ownership of a property from one entity to another in the present or in the future. In the act, the term “transfer” refers to the process of transferring property rights to a living entity. This “living entity” can be a company, an association of persons or a body corporate.

Scope of the Transfer of Property Act

The Scope of Transfer of Property Act covers the laws regarding transactions in immovable properties (like land, buildings, etc.) between living persons. It covers different transactions such as:

- Sale of property

- Giving property on lease/rent

- Mortgaging property to take a loan

The Act’s main goal is to establish straightforward laws and directives that will guarantee the smooth transfer of these property rights, with no conflicts or disagreements. But, this Act is not applicable to all kinds of property transfers. Its scope only includes immovable properties such as land and buildings.

Despite this limitation, the Act still manages to simplify and make secure most of the common property transactions that people engage in related to buying, selling, renting or mortgaging immovable properties. So, basically, It is a law that lays down the processes and rules for legally transferring ownership rights in immovable properties from one living person to another through sale, lease or mortgage transactions.

How are Properties Transferred in India?

The transfer of property acts stipulates six methods of handing over the rights of a property from one person to another. These methods have been given a rundown below:

1. Transfer of Property through Sale

Section 54 of the Transfer of Property act enumerates the provisions related to the sale of an immovable asset. According to the act, when the ownership of the property is transferred to a buyer for an amicably decided price, it is called the transfer of property through sale. Here, the ownership is transferred only when the sale deed is registered at the sub-registrar’s office.

Is Sale Deed Similar to Sale Agreement?

Often used interchangeably, there are a few differences between a sale deed and agreement that you must know.

| Sale Deed | Sale Agreement |

| It authenticates the transfer of ownership | It is a document that states the possible ‘future transfer of the property’ |

| Valid till any further transfer | It is valid only till the sale deed is signed |

| Mandatory to register the sale deed at the sub-registrar’s office | Registration is not mandatory. However, a sale agreement has to be executed on a non-judicial stamp paper |

| All the payments details, including the amount received and mode of payment are mentioned in sale deed | It gives an overview of how the payment will be made |

| Mandatory to submit stamp duty and registration charges in order to execute the sale deed | Although not everywhere, but in some states like Maharashtra, stamp duty has to be submitted for sale agreement also |

| The risks associated with the concerned property is transferred to the homebuyer | Risks do not get transferred through a sale agreement |

2. Transfer of Property through Gift Deed

A gift deed is a voluntary method of transferring the ownership rights of your property to someone else. There lies a small difference between the property transfer process through the sale and through a gift deed. In the former, you requilinish your house ownership for a fixed sum of money. In the latter, you transfer the property ownership without any monetary considerations. The details pertaining to the Gift deed has been explained in section 122 of the Transfer of Property Act.

3. Transfer of Property through Exchange

You must have heard about the barter system, where 2 persons mutually transfer the ownership of one thing for the ownership of another. This type of system is also enumerated in the Transfer of Property Act where the term “exchange” includes both movable and immovable assets. So when it comes to the applicability of the transfer of property act in the real estate sector of India, we are referring to the exchange of ownership of one property with another.

For example, Sneha and Neha’s properties are valued at Rs. 50 Lakhs and Rs.53 Lakhs, respectively. So when Neha will exchange the property with Sneha, she can pay Rs. 3 Lakhs through cheque.

Note: The transfer of priority through exchange is made in a manner prescribed for the transfer of ownership rights by sale.

4. Transfer of Immovable Property through Lease

A lease is another method defined in The Transfer of Property Act, 1882. Here, the property is transferred for a set time period without giving the ownership rights. This means that the possession of the property is transferred from one entity to another. In case the lease has to be executed for more than a year, then it has to be done via a registered deed.

The lessor (person who leases out a property) has the right to take back the possession from the lessee if the terms and conditions of the deed are breached. Additionally, it is the responsibility of the lessor to disclose any material defect relating to the property.

5. Mortgage and Property Transfer

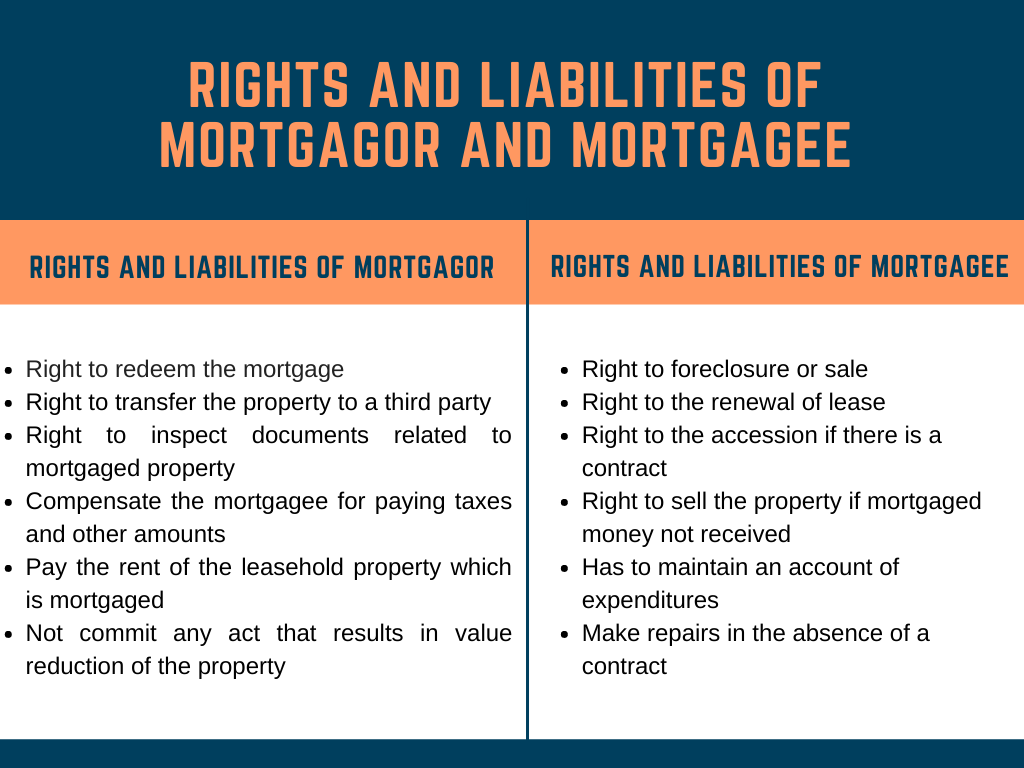

When you take a loan from someone and offer an immovable asset as a collateral, it is called the mortgage system. In India, different types of mortgage systems like simple and usufructuary mortgages have been enumerated in the transfer of property act, 1882.

The act lists down the liabilities as well as the rights of the mortgagor (property transferor) and the mortgagee (to whom the property is transferred). For example, if the mortgagor fails to repay the loan amount, the mortgagee gets the right to seize or sell the property concerned.

6. Understanding Actionable Claim

One of the most important provisions in the TPA is with regard to the Actionable Claim. As the term suggests, you can take an action against a particular claim in court to recover the unsecured debt. For example, X lends Rs. 2 lakhs to Y without any collateral. If Y does not repay the dues, X can approach the court. Hence, as per the transfer of property act, an actionable claim is when the debt is not secured by a mortgage of immovable property.

Which Properties Cannot be Transferred?

The transfer of property act specifies a list of instances where the property cannot be transferred from one individual to another. Some of these have been explained below:

| Conditions | Explanation |

| Inheritance | The act does not cover property transfers based on inheritance. |

| Re-entry | The lessor cannot transfer his right of re-entry to a third person. For example, P leased his property to Q and decided that he can re-enter after 1 year if the dues are not met. This right of re-entry cannot be transferred by P to someone else. |

| Easement Rights | You also cannot transfer the easement rights (using someone else’s land) to another person or company. For example, X has been given the right to passage by Y. Now Y can’t transfer this right to Z. |

| Personal or Restricted Interest | Section 6 of the transfer of property act restricts giving away the “interest restricted in its enjoyment.” For example, if P lent a flat to Q for his personal use, Q can’t transfer his enjoyment right to R. |

What is Section 58 of the Transfer of Property Act?

Article 58 addresses the entitlements of a tenant when the property owner transfers or sells the rented premises to another party.

Basically, this part means if the owner who is renting out the property decides to sell it to someone else, this action will not change the lease contract that is already in place or the rights of the person who is leasing.

The key Points are:

- The new owner/transferee has to honor the lease agreement made by the previous owner.

- The person renting can keep using the property like before with the owner who just bought it.

- If the owner sells without agreement from the person renting, then that renter has a right to ask for money in return from the owner.

- Should the property become unusable for the lessee because of what the new owner has done, then it is possible for the lessee to ask for a financial reimbursement from this new owner.

Article 58 secures the rights of a tenant regarding the property they are renting, even when the property gets a new owner while being leased.

Transfer of Property Act : Key Factors for Land Transfer

From the paragraphs mentioned above, you must have got an overview of what transfer of property act is. Let us now take a quick look at the factors that you must consider while transferring the immovable asset.

- The transfer has to be between two living entities.

- The property must satisfy the conditions for being transferred.

- Provisions of the act have to be complied with in order to transfer the property.

- Both transferor and transferee must be competent to execute the transaction.

- It should not oppose the nature interest

Being Competent

Being competent according to Transfer of Property Act, 1882, means that person must meet certain criteria to legally transfer the property. These criteria are prescribed from the Contract Act, 1872, which states that a person is competent to contract only if they are of the age of majority that is 18 years, is of sound mind and is not disqualified from contracting by the law.

Condition restraining alienation

This legal provision pertains to limitations on the ability to transfer ownership of property. If property is transferred with a condition or restriction that completely prevents the recipient or anyone claiming through them from selling or transferring their interest in the property, that condition or restriction is considered invalid. However, there is an exception for leases where such conditions benefit the lessor or their successors.

This law talks about restrictions on giving away property. If someone gives property to another person with a rule that says they can’t sell it or give it away, that rule is usually not allowed, unless it’s a lease and the owner benefits.

However, it’s allowed to transfer property to or for the benefit of a woman (who is not Hindu, Muslim, or Buddhist) with the stipulation that she cannot transfer or encumber the property or her beneficial interest in it during her marriage.

The last line means that if someone gives property to a woman who is not Hindu, Muslim, or Buddhist, they can include a condition that during her marriage, she cannot sell the property or use it as collateral for a loan. This condition is allowed under the law.

Rule against perpetuity

This rule basically says that when someone transfers property, they can’t make it so that the ownership or interest in that property will only happen after the lifetimes of certain living people and the minority (being underage) of someone who hasn’t been born yet. In simpler terms, you can’t create an ownership situation that only kicks in after certain people are no longer alive and a person who hasn’t even been born yet grows up.

Direction for accumulation

This law talks about what happens when someone gives property with a condition that the money earned from it must be saved up for a long time. If this time period is longer than the life of the person who gave the property or 18 years from when it was given, then that condition is not allowed.

However, there are some exceptions:

- If the money is being saved up to pay off debts.

- If it’s being saved to provide for the children or future family members.

- If it’s to keep the property in good shape. In these cases, the saving condition is still allowed.

Conditional Transfer (Section 25)

Section 25 of the Transfer of Property Act states that when property transfers are based on conditions, if those conditions prove impossible, unlawful, hazardous, or immoral then such transactions become void. For instance, suppose there’s a condition in an agreement like walking one hundred miles per hour; it would be deemed invalid as the action is physically not possible for any individual to perform within that timeframe! Similarly if the terms involve activities against legal norms, say requesting someone to commit crimes then also such transactions are declared null and void.

Transfer to Members of a Class Who Attain a Particular Age (Section 22)

Section 22 of the Transfer of Property Act states that when property is given to a collective, individuals within this group won’t acquire rights until reaching an agreed-upon age limit. Until then, no one can claim any part of it; only upon achieving said milestone will they legally own their share in its entirety.

FAQs

Q. What is the Relevance of Capital Gains Tax in Property Sale?

As the term suggests, the profits incurred from the sale of a “capital asset” like property, vehicle and jewellery is called capital gains. The profit gained is considered a part of income and is therefore taxed. This is referred to as capital gains tax.

So when we talk about the transfer of property act and its related provisions, the sale of property attracts a 20% capital gains tax. This, however, is valid on properties that you sell after holding it for more than 2 years (long-term capital gains tax). For properties that are sold before 2 years, the tax is calculated as per the slabs. Once cheques are issued and the payment is encashed, the seller is liable to pay a capital gains tax on the sale of the property.

Q. Which goods or services are not included in capital assets?

1. Personal goods

2. Bearer bonds

3. raw materials/stocks for business

4. Agricultural land in rural space (within a specified distance)

Q. What is Transfer of Property through Relinquishment?

Recently, a person X passed away without creating a will. In such a scenario, where X died “intestate,” the property will be inherited by his legal heirs. As per the Hindu Succession Act of 1956, the legal heirs of X can be his wife, daughters, or sons.

If in the future, the wife wants to transfer her shares of the property to her daughter, she can do this by executing a relinquishment deed. Simply put, a release or relinquishment deed is a legal document through which a property is transferred from one co-owner to another.

Hence, the transfer of property act offers multifarious ways for transferring your property to near and dear ones. Since this is an emotional affair, you must consider your needs and requirements before executing the deed. Additionally, pay special attention to the rules and legal processes, memorandum of understanding, and other such factors in order to conduct the transaction seamlessly.

![Well, #GrowWithPropacity is here to educate you all about all things Real Estate.

Follow to stay updated in Real Estate!

[Real Estate, Construction, Real Estate Tips, Real Estate Growth, Real Estate Industry, Carpet Area, Super Area, Built Up Area, Home Buying Tips, Home Buyers, Property]](https://propacity.com/blogs/wp-content/plugins/instagram-feed/img/placeholder.png)

Leave a Reply